Cheapest way to send money from Canada to UK?

After three years living in Canada, I recently left for rainier shores: Ireland. But I still have $5,000 in a Canadian bank account. What's the cheapest way of getting that into my UK bank account?

Currency exchange stores

I could have simply taken the $5,000 with me in cash, and then exchanged it for pounds at a currency exchange store in the UK. How much would this cost? I googled "currency exchange store London" just now, and Thomas Exchange Global was among the results. They'd buy $5,000 for £2,398. That's a charge of 1.5%. Not bad.

But a tourism office in Dublin charges 4.3% for converting Canadian dollars to euros. It's even worse at Currency Exchange Dublin, which proclaims to be "Dublin's number one currency exchange store". Here the charge is 6.5%. Quite a difference from the exchange store in London. The lesson then is to shop around.

TD

I didn't take the money in cash with me. I left it in a bank account in Canada. The bank is TD, one of Canada's largest banks, and their internet banking service allows me to send money abroad via an international money transfer. There's a limit of $2,500 a time though.

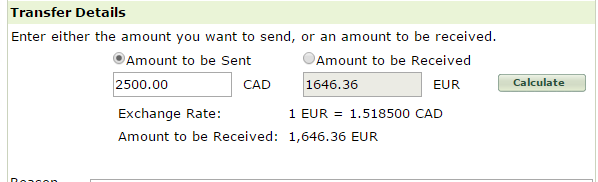

Here's what TD's online international transfer service looks like.

What’s the cost? Well first, there's a $12.50 fee. Second, there's the imperfect exchange rate. I calculate TD charges 2.8% through that. So add to this the $12.5, and the total fee is 3.3% for sending $2,500. This means I lose nearly $100 when I transfer $2500 to my UK bank account. On the upside, it takes just a few clicks and the money arrives in my UK account the next day. Because it's so easy, I've used this service several times.

CurrencyFair

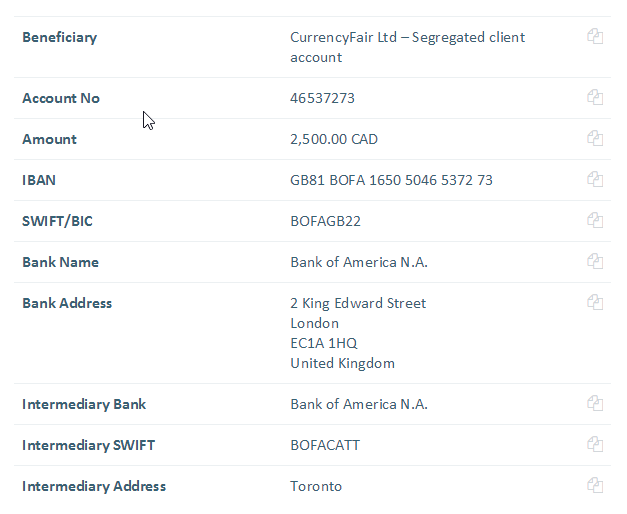

There are websites offering with cheap currency exchange services. First I tried CurrencyFair. They seem to charge less than 1% for exchanging Canadian dollars to British pounds. But when I tried to transfer money, CurrencyFair gave me all this information to pass on to my bank :

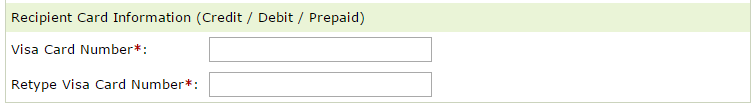

Look at all this! Why is there so much information? I can't enter this into the TD online banking system, because it only accepts debit and credit card numbers - not IBANs, BICs, and all this other shit.

TD's online international transfer system. Note the recipient's details have to be a visa card number. It doesn't accept IBANs and BICs.

I found out that I would need to go into a TD branch (see here and here). So basically, I can only use CurrencyFair if I'm physically in Canada.

XE.com

Next I tried xe.com/fx. They charge 2.5%, which is higher than CurrencyFair but still less than sending the money directly to my UK account from TD. Plus they have a promising 'debit my account' option, which means I can send money without having to be physically present in Canada. But I ran into a problem:

Please note that ‘Debit my account’ option would only be made available if your country of sign up is in the United States or Canada. You can use Wire instead in sending the funds to us.

So basically:

- If you have a Canadian XE account, you can deposit your funds into it for FREE by debiting your Canadian bank account. YAY!

- If you have a UK XE account, this option isn't available. Instead you have to send money to XE with a wire transfer. How do you send a wire transfer? From a Canadian bank branch. Which you can't do if you're not physically in Canada.

So, if my country of sign up is Canada, then I can make transfers using direct debit. So I tried to make a new account based in Canada, but XE refused, saying I can only have one account at a time. Then I asked if I could simply change my country of residence to Canada, but they said no - they'd have to close the account and I'd have to make a new one. So I tried that. XE then asked for a copy of a Canadian bank statement and a statement from a guarantor in Canada to prove I'm living in Canada. At this point I gave up. XE seem to want to be really really sure that I'm living in Canada.

PayPal

PayPal offers a way to send money from Canada to the UK, plus you don't have to be physically present in Canada to do it.

- Open a PayPal account in Canada

- Deposit the money from your Canadian bank account into your Canadian PayPal account.

- Open a PayPal account in the UK

- Send the money from your Canadian PayPal account to your UK PayPal account.

- Withdraw the money from the UK PayPal to your UK bank account

But PayPal's lousy exchange rate means you lose a whopping 4.0% every time you do this. Here's the calculation:

- At the time of writing, PayPal’s exchange rate was 1 CAD = 0.65123 EUR

- The perfect exchange rate was 1 CAD = 0.67738 EUR (according to Google)

- (0.67738 / 0.65123) - 1 = 4.0%

And PayPal don't make their currency exchange rates easy to find. Here's how to find them:

- Click on the Wallet tab.

- Click PayPal balance.

- Click Manage currencies.

- On this page there'll be a currency conversion calculator.

Summary

Here's a summary of my findings:

| Place | Amount receiver would get if you send €5,000 | Charge | Can you send money from outside Canada? | Can you open an account from outside Canada? |

|---|---|---|---|---|

| Currency exchange stores | £2,275 to £2,397 | 1.5-6.5% | No | n/a |

| TD bank's Visa Money Transfer | £2,375 | 3.0% | Yes | No |

| CurrencyFair.com | £2,433 | 0.7% | No | No |

| xe.com/fx | £2,400 | 1.4% | Yes | No |

| PayPal | £2,343 | 3.9% | Yes | Yes |

- If you're still in Canada, use CurrencyFair.

- If you're leaving Canada soon, considering taking Canadian dollars with you in cash and finding a cheap currency exchange bureau in the UK. Also, open an XE account before leaving, because you can transfer funds with them using direct deposit.

- If you've already left Canada and you didn't open an XE account, then an online international bank transfer may be cheaper than using PayPal.

Comments

2021-04-06 Brian

Thanks very much. Extremely helpful.

Reply

2018-11-24 M.Mays

Thanks so much for the information. I am having the same problem with the Canadian banking system. I did use Visa direct when I was in Canada but it would not transfer to my UK account when I am sitting in the UK. I had used Visa Direct with the TD account when I was in Canada and it worked. Now that I am in the UK and I cannot transfer my money. I was told by a TD agent that my UK account does not have Visa direct??! Now I am trying to figure out the best way to get my money!

Reply

Leave a comment