How to invest your money if you're in the UK

I've been investing my money for ten years now. I've used a variety of online platforms, including The Share Centre, Legal and General and Hargreaves Lansdown. And I've tried investing in everything from individual stocks, unit trusts and even microloans.

To save you the time and hassle of going through everything I already have, I'm going to tell you what I've learned.

Lesson 1: Don't buy individual stocks; buy ETFs or unit trusts instead

When I first started investing, I bought stocks in companies like BP, Domino's Pizza, whatever company I thought would make me money. Some of my trades went well, others went badly and most trades were somewhere in between.

However, I don't recommend buying stocks in individual companies like I did. The first reason is that the fees are too high. The second reason is that it's too much work to have to research companies to invest in. Fuck that.

The solution is exchange traded funds (ETFs) and unit trusts. These are big collections of shares in hundreds of companies. You can invest in ETFs that follow the FTSE 100 or the NASDAQ, for example. And the best thing is that they're cheaper than investing in individual companies.

Lesson 2: Choose the cheapest trading platform

Hargreaves Lansdown

I recommened Hargreaves Lansdown because their fees are low. They have an annual charge of 0.45%, on top of which you also pay the fund charge, which can vary from 0.04% to 2%, depending on the fund your choose.

So, if you have £10,000 invested in a fund with a charge of 0.05%, then you'd pay Hargreaves Lansdown £50 annually. Not bad at all.

iWeb

Recently I found an even cheaper option. It's called iWeb and it’s run by Halifax. Their fee system works a bit differently to the rest. iWeb will charge you £25 to open account, £5 for every trade and then the fund charge.

So if you have a £10,000 invested in a fund with a charge of 0.05%, you'd pay iWeb £35 (£25 account opening fee + £5 trade charge + £5 annual fund charge) the first year and then just £5 every year after that.

In all, it's very good. So I recommend going with iWeb.

Lesson 3 Choose funds with low fees

To reduce your fees as much as possible, and thereby increase your profits, you should choose a cheap fund.

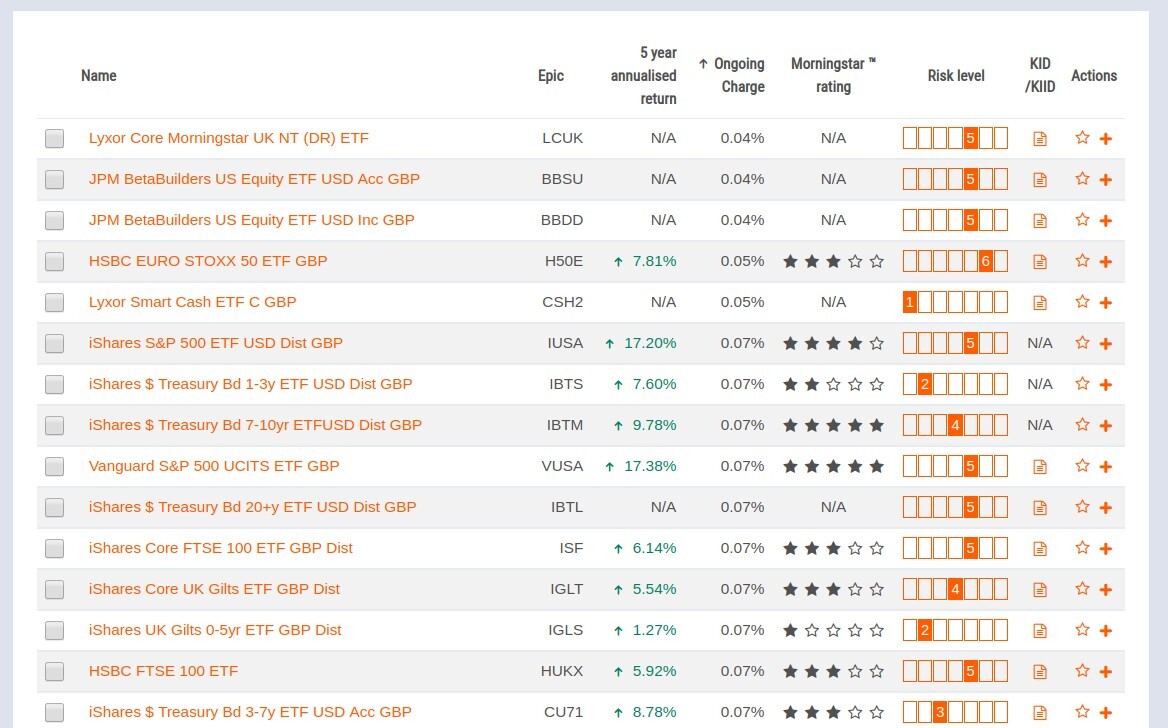

You can see the ETFs that iWeb offers by going to https://www.markets.iweb-sharedealing.co.uk/share-centre/etfs/. At the moment there are 542 of them. If you scroll down to the list and click on "ongoing charge" twice, you can sort them by fee with the ETFs with the lowest fees first.

The ETFs with the lowest fees are:

- Lyxor Core Morningstar UK NT (DR) ETF

- JPM BetaBuilders US Equity ETF USD Acc GBP

- JPM BetaBuilders US Equity ETF USD Inc GBP

I don't know what these funds are. However, they all have a fee of 0.04%, which is nice. It means that if you have £10,000 invested than you only pay iWeb £4 per year.

Two ETFs I'm invested in and can vouch for are:

- ISHARES CORE SP 500 UCITS ETF USD (IUSA)

- VANGUARD FUNDS PLC SP 500 UCITS ETF USD DIS (VUSA)

Both of these have fees of 0.07% per year, which is still incredibly low.

Conclusion

The best way to invest your money is by buying units in unit trusts and/or ETFs. To keep your trading costs low, I recommend using iWeb as your trading platform, as it's the cheapest. Try to find funds that have low fees (<0.1% per year) to keep your trading costs as low as possible.

If you have any questions, ask them to me in the comments.

Comments

2019-11-06 bestringtoness.com

For as little as $10, you can invest in Worthy Bonds . Worthy Bonds are fixed interest bonds that fund loans for creditworthy American businesses. The bonds have a term of 36-months, but interest is paid weekly and you can withdraw your money at ANY time, without penalty. Buy as many $10 bonds as you d like.

Reply

Leave a comment